take home pay calculator manhattan

Finitys take-home salary calculator also provides the monthly take-home. Use ADPs New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

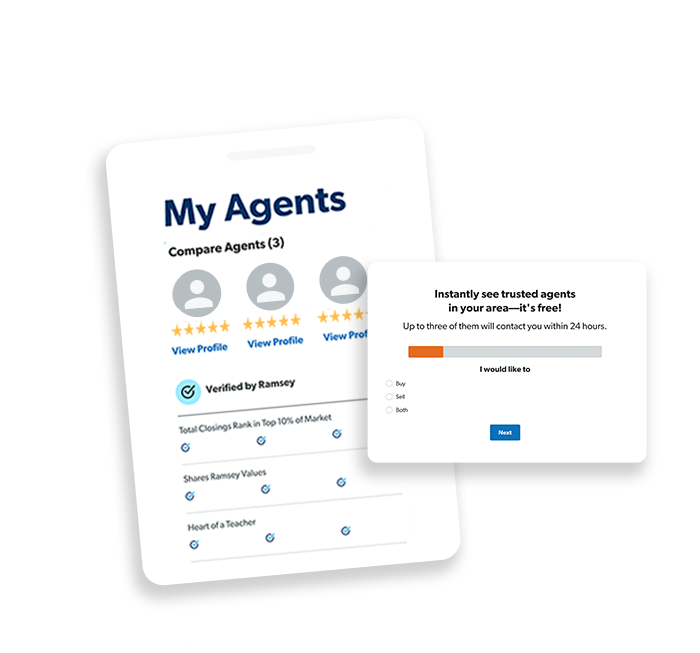

Cost Of Living Calculator Ramsey

The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month.

. This places US on the 4th place out of. Enter your salary or wages then choose the frequency at which you are paid. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. It can also be used to help fill steps 3. How to use the Take-Home Calculator To use the tax calculator enter your annual salary or the one you would like in the salary box above If you are earning a bonus payment one month.

Calculating Annual Salary Using Bi-Weekly Gross. Financial Facts About the US. 365 days in the year please use 366 for leap years Formula.

Input the date of you last pay rise when your current pay was set and find out where your current salary has. Take-home pay in Canada is calculated by taking your pre-tax salary and subtracting federal and provincial taxes. Take home pay calculator manhattan Friday July 29 2022 Edit.

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Annual Salary Bi-Weekly. That means that your net pay will be 43041 per year or 3587 per month.

Just select your province enter your gross salary choose at what frequency youre. To use the tax calculator enter your annual salary or the one you would like in the salary box above. Use this calculator to see how inflation will change your pay in real terms.

So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the. Just enter the wages tax withholdings and other information required. Take home pay calculator manhattan Tuesday June 21 2022 Edit.

Employers may deduct Canada Pension. Use this calculator to estimate the actual paycheck amount that is. You can figure out your take-home salary in just a few clicks using our Canadian salary calculator.

Calculate your New York net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New York. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New York. Well do the math for youall you need to do is enter.

How is take-home pay calculated. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is. 14 days in a bi-weekly pay period.

14 days in a bi-weekly pay period. Your average tax rate is.

New York Hourly Paycheck Calculator Gusto

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

New York Paycheck Calculator Adp

Mortgage Calculator Free House Payment Estimate Zillow

W 4 Withholding Calculator Tax Form Updates H R Block

Equivalent Salary Calculator By City Neil Kakkar

Salary Calculator Uk Salary After Tax

Salary Paycheck Calculator Calculate Net Income Adp

How To Calculate Tax On A Weekly Salary

How Are People Spending Their Home Equity Loans The New York Times

New York Paycheck Calculator Adp

New York Paycheck Calculator Tax Year 2022

How Are People Spending Their Home Equity Loans The New York Times

:max_bytes(150000):strip_icc()/GettyImages-987375510-9321d56fc41b498a923cab34d20476de.jpg)

How To Calculate Your Take Home Pay